ETH Price Prediction: Is $12,000 the Next Stop?

#ETH

- Technical indicators show ETH in bullish territory with MACD crossover and price above key moving averages

- Whale accumulation and ETF inflows demonstrate strong institutional demand

- Breaking $4,200 resistance could trigger momentum plays toward $12,000 targets

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

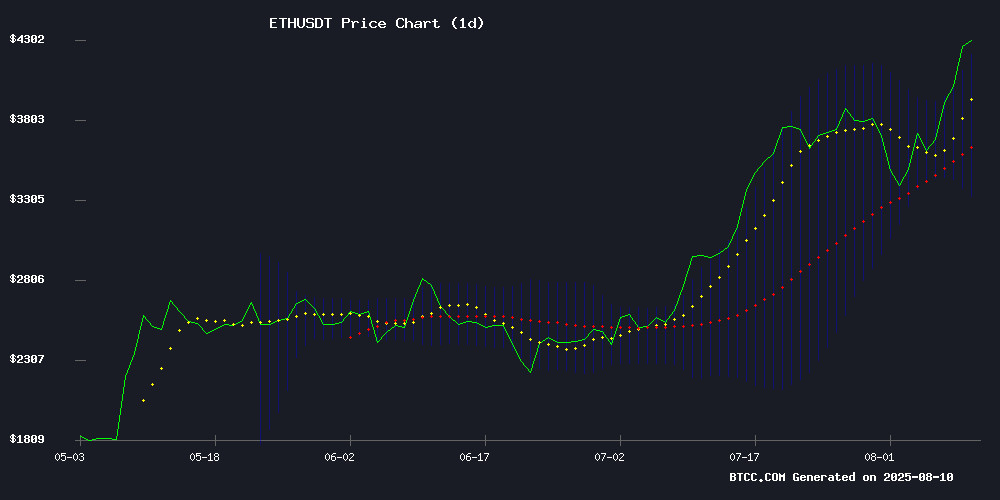

According to BTCC financial analyst Emma, ethereum (ETH) is currently trading at $4,184.32, above its 20-day moving average (MA) of $3,764.04, indicating a bullish trend. The MACD histogram shows a positive crossover at 70.05, suggesting strengthening momentum. ETH is also testing the upper Bollinger Band at $4,180.00, which could signal an overbought condition but also reflects strong buying pressure. Emma notes that a sustained break above $4,200 could open the door for further upside.

Ethereum Market Sentiment: Whales and ETFs Drive Optimism

BTCC financial analyst Emma highlights that Ethereum's 22% weekly surge and whale accumulation of $7 billion in ETH over 30 days have fueled bullish sentiment. News of SEC's potential crypto pivot and $460M inflows into US Ethereum ETFs further support the rally. Emma cautions that while derivatives activity and institutional interest are positive, traders should monitor resistance levels near all-time highs.

Factors Influencing ETH's Price

Ethereum's 22% Weekly Surge Sparks $5,000 Target Speculation

Ethereum (ETH) has surged 22% in the past week, briefly touching $4,300 for the first time since November 2021. This marks the most significant rally in nearly three years, fueled by retail enthusiasm, institutional accumulation, and a supply backdrop shaped by staking. Traders are now eyeing $5,000 as the next key target.

Retail investors are driving the momentum, with social media sentiment overwhelmingly bullish. Hashtags like #buying and #bullish appear twice as often as bearish counterparts. Santiment data suggests strong retail participation, though analysts caution that excessive Optimism could precede short-term pullbacks.

Institutional players have also contributed to the rally. Blockchain data from EmberCN indicates significant accumulation by large investors since mid-July. The combination of retail FOMO and institutional demand has created a potent upward trajectory for ETH.

Big Ethereum (ETH) Investors Accumulate $7 Billion in 30 Days Amid Price Rally

Ethereum whales have aggressively accumulated over 1.8 million ETH worth $7 billion in the past month, coinciding with a 50% price surge toward the $4,200 resistance level. Their holdings now represent 23.6% of circulating supply, reducing market liquidity and potentially fueling further upside.

Fresh ETF inflows and exchange balances hitting nine-year lows suggest sustained demand, though the RSI above 70 warns of potential short-term overheating. Analysts like Ali Martinez project a $6,400 target if ETH decisively breaks $4,000, while others eye $4,500 as the next technical threshold.

The whale activity creates a self-reinforcing cycle—their purchases constrain supply while retail traders often mirror large wallet movements. This comes as institutional interest grows through both spot accumulation and derivatives positioning across major exchanges.

Ethereum Nears All-Time High Amid Derivatives-Driven Rally

Ethereum surged past $4,300 over the weekend before a mild retracement, marking a 4.3% daily gain as derivatives activity fuels momentum. Analysts now eye $4,400 as the next resistance level, with $4,210 serving as critical short-term support.

The rally coincides with growing staking activity and exchange inflows, suggesting institutional accumulation. Market watchers caution that a drop below $4,150 could trigger cascading liquidations.

Up 49% in 1 Month, Is Ethereum a Screaming Buy Right Now?

Ethereum (ETH) surged 49% over the past month, reaching $3,896 by August 8, reigniting debate over whether the smart contract leader has broken free from its prolonged slump or is simply rebounding from oversold conditions. Institutional inflows into ethereum ETFs have topped $8.7 billion in their first year, creating sustained buying pressure.

The Pectra hard fork, launched May 7, introduced validator cap increases, reduced gas fee volatility, and laid groundwork for future efficiency upgrades. Coupled with the Ethereum Foundation's new security initiative, these developments suggest the rally may have staying power. Persistent institutional demand and technical improvements position ETH for potential continued gains, though risks remain.

Vitalik Buterin Regains Billionaire Status As Ethereum Hits Multi-Year Highs

Ethereum surged to $4,330, its highest price since November 2021, propelling co-founder Vitalik Buterin back into billionaire status. His publicly tracked wallets now exceed $1 billion in value.

The cryptocurrency has rallied over 200% since April, outperforming most major digital assets. Growth stems from robust DeFi adoption, expanding layer-2 solutions, and institutional demand. Exchange balances sit at multi-year lows, signaling accumulation by long-term holders.

Network activity and use case expansion suggest continued momentum. Market observers anticipate potential all-time highs as regulatory clarity improves and ecosystem development accelerates.

Ether Surges Past $4,200 as Whales Accumulate Over $4 Billion in ETH

Ethereum has breached the $4,200 level for the first time since December 2024, fueled by a combination of retail optimism and institutional accumulation. Social media sentiment skews heavily bullish, with hashtags like #buying and #bullish outpacing bearish counterparts by a 2:1 margin.

Behind the rally lies a staggering $4.17 billion institutional buying spree. Blockchain data reveals over 1.035 million ETH acquired since July 10, coinciding with a 45% price surge. The average purchase price of $3,546 suggests strategic positioning by institutional players, excluding known ETF addresses.

SEC’s Crypto Pivot Could Supercharge Ethereum and DeFi

The U.S. Securities and Exchange Commission (SEC) appears to be shifting its stance on digital assets, a move that could have significant implications for the crypto market. Bitwise CIO Matt Hougan describes a recent speech by SEC Chair Paul Atkins as "the most bullish government document" in his crypto career, outlining a regulatory blueprint dubbed "Project Crypto" aimed at fostering innovation and U.S. leadership in the sector.

Despite the potential impact, the market has yet to price in this development. Hougan argues that a more favorable regulatory environment could catalyze growth across multiple crypto sectors, particularly Ethereum and decentralized finance (DeFi). The speech emphasizes modernizing digital asset regulation to align with technological advancements and global competition.

Binance Moves Significant ETH to Wintermute Amid Price Surge

Binance executed large-scale Ethereum transfers to Wintermute-linked addresses as ETH's price breached $4,000. The exchange initially moved batches of 250-500 ETH before escalating to single transactions exceeding 8,000 ETH—worth approximately $12 million—within a four-hour window. These movements coincided with SharpLink's $200 million fundraising announcement to bolster its ETH treasury beyond $2 billion.

The dispersed transfers targeted multiple Wintermute-associated destinations including Bybit, Kraken, and Gate.io. Market observers note such exchange-to-market-maker flows often precede substantial trading activity. Ethereum's price ascent from $3,800 stalled slightly post-outflows, with $188.7 million in liquidations recorded amid heightened volatility.

While some analysts warn of potential selling pressure, others suggest the movements may support market liquidity. The $4,000 support level held despite retracement, leaving traders watching whether these institutional-scale transfers signal accumulation or distribution at current levels.

Ethereum Breaks $4.2K Resistance, Analysts Predict $12K Rally

Ethereum surged past $4,200 for the first time since December 2021, liquidating $207 million in short positions. The rally has sparked bullish predictions, with some analysts forecasting a historic run to $12,000.

Pseudonymous on-chain analyst Tracer told followers on X that a confirmed breakout could unleash a "MONSTER rally," while YouTuber Crypto Rover projected $6,000 on institutional demand. Glassnode data shows fresh demand entering the market, with a sharp rise in first-time and momentum buyers.

The 19% weekly gain and 7.5% daily jump have drawn attention even from unlikely corners, including Eric Trump, who tweeted his approval. BlackRock's potential spot ETH staking ETF approval could further fuel the rally.

BitMine Emerges as the World’s Largest Holder of Ethereum

BitMine has solidified its position as the largest corporate holder of Ethereum, with a treasury totaling 833,133 ETH worth over $3 billion. The disclosure, highlighted by market analyst Crypto Patel, signals a growing institutional appetite for ETH as a long-term investment rather than a speculative asset.

Thomas Lee, BitMine's chairman, has publicly emphasized Ethereum's macro significance, projecting its relevance for the next decade. This shift reflects broader industry trends toward decentralized finance and institutional adoption.

US Ethereum ETFs Rebound with $460M Weekly Inflow as ETH Tops $4,200

After a rocky start to August, US Ethereum ETFs staged a dramatic turnaround with four consecutive days of inflows totaling $460 million. The resurgence coincided with Ethereum's price breaching the $4,200 threshold, signaling renewed institutional confidence.

BlackRock's iShares Ethereum Trust (ETHA) led the charge with $254.73 million in Friday inflows alone, cementing its dominance with $12.35 billion in assets under management. Fidelity and Grayscale's offerings followed with $132.36 million and $38.25 million respectively, as investors responded to regulatory tailwinds including expanded retirement plan access.

Is ETH a good investment?

Based on current technicals and market sentiment, BTCC's Emma suggests ETH presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +11.2% premium | Bullish trend confirmed |

| MACD | Positive crossover | Momentum building |

| Whale Activity | $7B accumulation | Strong institutional demand |

| ETF Flows | $460M weekly | Growing mainstream adoption |

Key risks include potential overbought conditions near $4,200 and derivatives market froth. Dollar-cost averaging may be prudent.